Avocado Investing & Market Insights

Explore Insights

CURRENT PERSPECTIVES ON THE GLOBAL AVOCADO MARKET

In this report, we explore the evolution of the global avocado market from a niche fruit to a booming international commodity. Driven by rising health trends and growing plant-based consumption, avocados now present real opportunities across agriculture, logistics, and emerging markets.

We analyze major supply shifts, from Mexico’s dominance to the rise of Peru, Colombia, and Kenya. Despite climate volatility and logistics constraints, the sector remains attractive due to stable demand, ESG-driven premiums, and room for value-chain innovation.

Rebalancing in the Digital Era: Confronting AI Overexposure Amid U.S. Equity Concentration

In this publication we analyze the structural risks emerging from this concentration dynamic and discuss why strategic rebalancing and diversification particularly through real assets such as agriculture are essential to ensure portfolio resilience and long-term value preservation. For those seeking a deeper understanding of the opportunities and systemic risks shaping the AI era, we invite you to explore the full article.

The Incredible Rise of Avocados: A True Success Story

Discover how avocados have transformed from a misunderstood fruit into a global sensation. Over the past two decades, they’ve become a staple in kitchens and a symbol of health and sustainability. This meteoric rise didn’t happen by chance—it’s a result of tireless efforts in promotion, research, and innovation.

Summary: The U.S. Economic Contributions of Hass Avocado Imports from Mexico | 2024 Update

The 2024 report, prepared by Dr. Gary W. Williams and Dan Hanselka of Texas A&M University, analyzes the economic contributions of Hass avocado imports from Mexico to the U.S. economy for fiscal year 2023/24. It highlights the growing significance of Mexican avocados in the U.S. and provides a historical perspective on their impact since 2012/13. The study also includes a special focus on the state economies of California and Texas, the two largest avocado-consuming state.

Economic Impact of Mexico-U.S. Avocado Trade: Key Insights and Growth Trends

The Mexico-U.S. avocado trade has reached unprecedented levels, significantly benefiting both economies. According to the Avocado Institute of Mexico's 2023-2024 Economic Report, U.S. imports of Mexican Hass avocados amounted to $3.52 billion in the last fiscal year (July 2023 – June 2024). This trade contributed $7.5 billion to U.S. economic output, $4.2 billion to GDP, and supported over 42,000 American jobs, generating $2.5 billion in labor income and $1.1 billion in taxes.

AVO Oro Verde: La primera estructura de inversión para la producción de aguacate

La evolución de las inversiones agrícolas refleja la transformación de un sector que, durante siglos, dependió exclusivamente de la propiedad de la tierra y del financiamiento tradicional. Con el tiempo, la agricultura se integró progresivamente a los mercados financieros, dando paso a nuevas estructuras de capital, modelos de gestión y vehículos de inversión especializados. Comprender este recorrido histórico es fundamental para contextualizar las oportunidades actuales en cultivos de alto rendimiento, como el aguacate, y para reconocer cómo la innovación financiera ha permitido acercar esta industria a inversionistas globales. Este artículo presenta esa trayectoria y el papel que hoy desempeñan las soluciones de inversión modernas en el desarrollo agrícola sostenible.

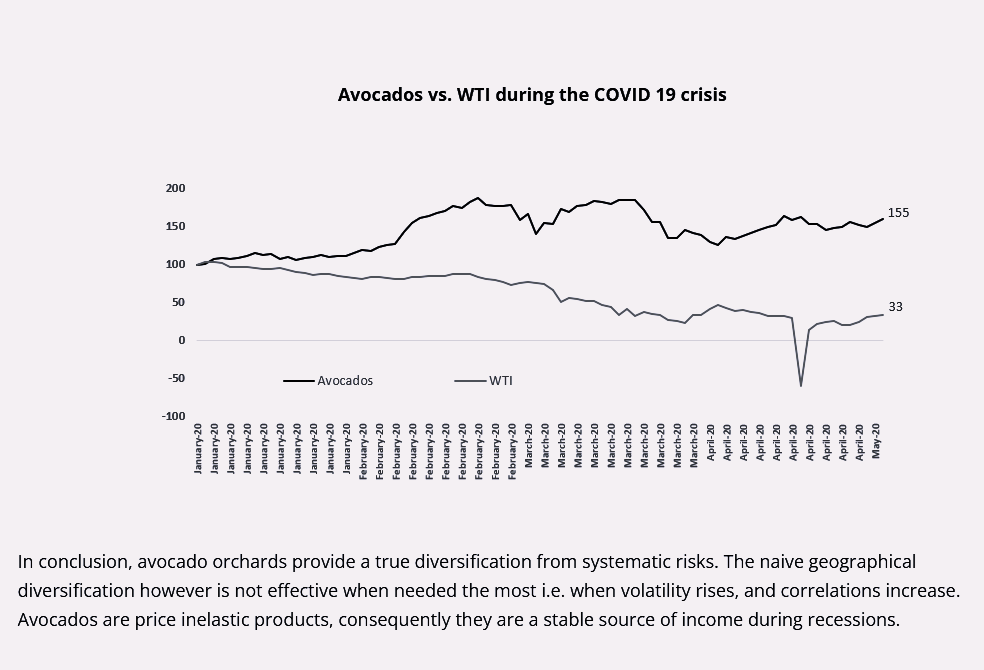

Portfolio diversification during the COVID 19 crisis: Preventing income shortfalls with avocado orchards

The COVID‑19 crisis exposed significant vulnerabilities in traditional income‑generating assets and highlighted the growing disconnect between market valuations, corporate earnings, and dividend stability. In this environment, portfolio diversification became a critical priority for investors seeking to preserve returns and secure dependable sources of income. This article examines that dislocation and evaluates the role of real assets, particularly avocado orchards, as a resilient complement to public‑market exposure. It outlines how these assets performed during the crisis and why their structural characteristics position them as a compelling alternative for investors navigating periods of heightened volatility and dividend disruption.

Questions? We’re Here to Help!

Disclaimer: This content is intended for accredited investors within the United States, Mexico, and Europe. Please review applicable regulations in your region.